Meaning of Ageing in Accounts Receivable

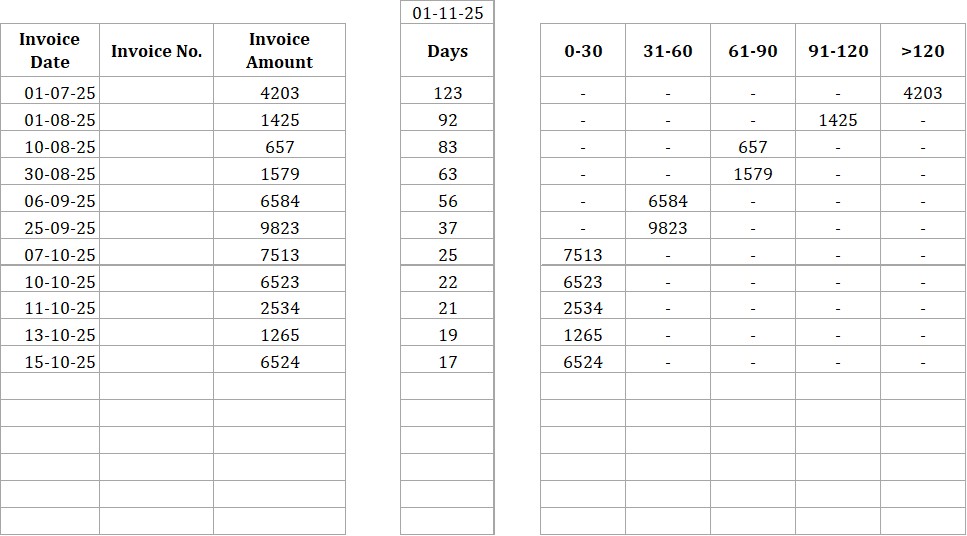

In accounts receivable, ageing refers to the process of categorizing outstanding customer invoices based on how long they have been unpaid. An ageing report groups receivables into time periods—such as 0–30 days, 31–60 days, 61–90 days, and over 90 days—to help businesses identify overdue accounts, monitor payment patterns, and manage cash flow. It is a key financial tool for evaluating credit risk and improving collection strategies.

Template Description:

An ageing report helps businesses track unpaid invoices by showing how long each payment has been outstanding. This blog explains what an ageing report is, why it’s important, and how it improves cash flow and credit management. Learn how to identify overdue accounts, spot payment issues early, and keep your accounts receivable organized. Whether you’re a small business or growing company, this guide makes understanding and using ageing reports simple and effective for better financial control.

Key Features of this Ageing Report

♦ Easy to Understand

♦ Easy Dynamic Excel Format

♦ Easy to Download Excel File

♦ Digital File

♦ 100% fully customizable template

An Ageing report look like this: Understanding the Ageing Report :

A Simple & Easy Guide for Businesses.

Download our professionally designed Ageing Report template to track unpaid invoices with ease. This simple, ready-to-use format helps you monitor overdue payments, improve cash flow, and manage accounts receivable efficiently. Perfect for businesses of all sizes.

Also Check & Download More Template

Analytical Target Vs Achievement Sale Report in Excel

Month Wise Analytical Sales Report Template

Sales Analytical Report in Excel

Visi Cooler Secondary Sale Analytical Report In Excel